Time for Another Tax Rebellion?

Here's an eminently zetetic question: Is it time to consider voluntary funding for the out-of-control spending by those in government?

It’s been over a century since the income tax was constitutionalized via the 16th Amendment. Now, Democrats in Congress, the White House, Governor’s mansions, and state legislatures—as well as progressive Republicans across the country—are looking for excuses to raise taxes on productive citizens.

Maybe it’s time to rethink taxes? Maybe it’s time to replace taxes with voluntary funding for government programs?

Gov’t Revenue: A Brief History

Prior to the 16th Amendment, which was ratified in 1913, the primary sources of revenue for the federal government were tariffs and excise (or consumption) taxes, as well as sales of land claimed by the federal government.

Tariffs are taxes imposed on finished products as well as raw materials imported into the United States from other countries. Tariffs can be used to generate revenue for the government. Significantly high tariffs—sometimes called “protectionist” tariffs—can also be used to give economic advantages to domestic growers, manufacturers, and businesses, by raising significantly the prices of imported goods.

Tariffs contain within themselves an intrinsic limiting feature. Increases in tariffs increase the prices of the goods being taxed. When politicians get greedy and raise tariffs too high—hoping the government will receive more revenue—people stop buying the highly-taxed, overpriced, tariffed goods. The results of excessive tariffs are usually less revenue for the government imposing the high tariffs.

The principle that higher rates of taxes/tariffs, after a certain point, result in less revenue for the government is sometimes referred to as the Laffer Curve, named after economist Art Laffer.

The principle was also understood by the authors of The Federalist Papers, an important reason why they supported tariffs as the primary funding mechanism for the government. Limiting government revenue, after all, is an effective means of limiting government power.

Excise taxes, also known as consumption taxes, are taxes placed on domestically grown and produced goods. An excise tax on whiskey caused one of the earliest challenges to power and authority of the federal government in the 1794 Whiskey Rebellion.

Prior to the Civil War, the federal government relied much more on tariffs for revenue than excise taxes. (Perhaps those in government wanted to avoid sparking more Whiskey Rebellions?) During and after the Civil War, however, the federal government turned to a mix of excise taxes combined with tariffs for the main sources of revenue.

From the American Founding through the early 20th century, the only direct, individual federal income was created in 1861 (and later revised) to fund the Civil War. Republican President Abraham Lincoln made it clear that the federal income was needed only for the duration and expenses of the War. It was temporary. Created by federal statutory law, Congress repealed the national income tax, in 1871, several years after the conclusion of the Civil War.

That would soon change, however, with the ratification of the 16th Amendment.

The 16th Amendment

Only one sentence long—The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration—the 16th Amendment, ratified in 1913, granted power to Congress to tax the personal income of individual citizens.

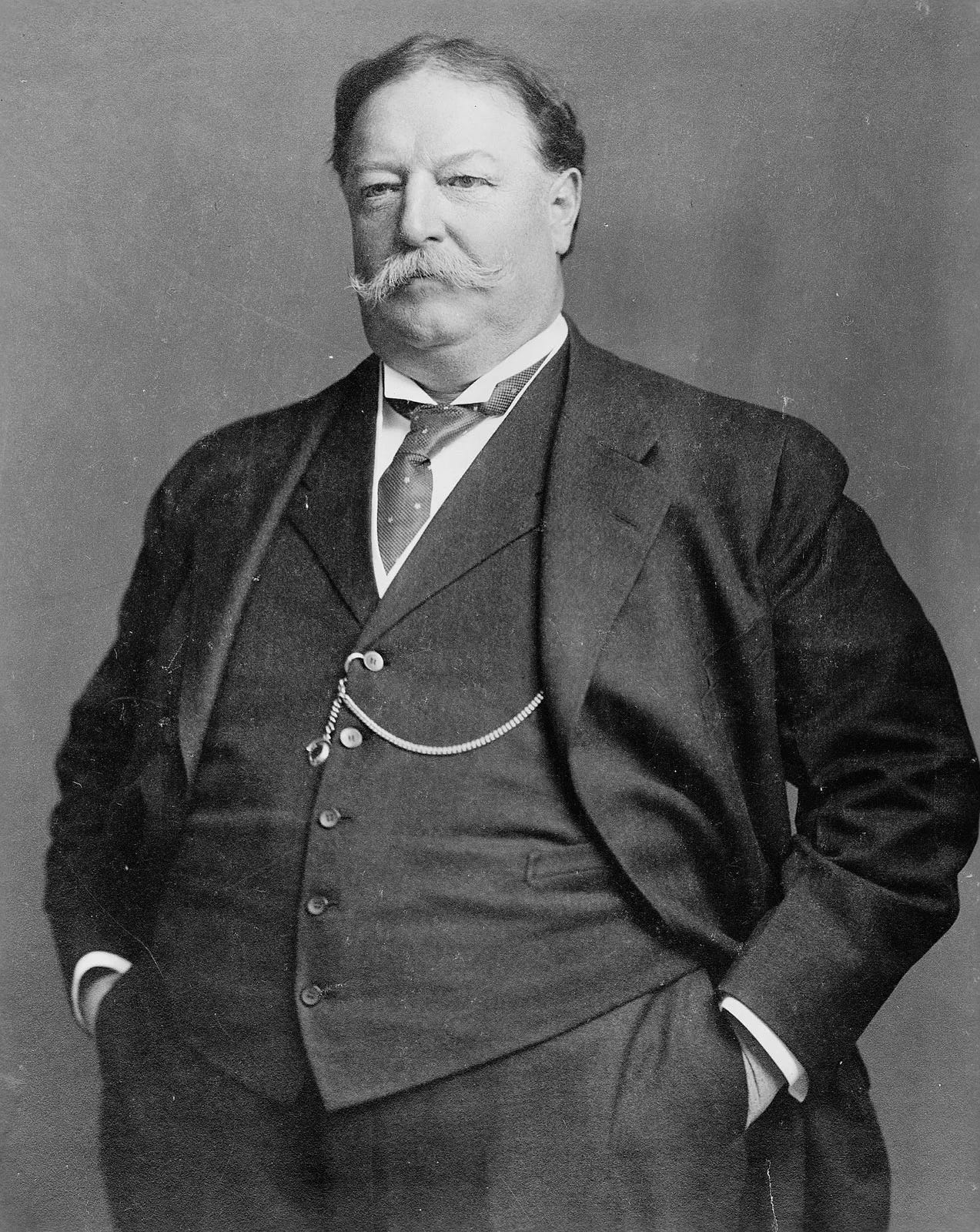

The push for the 16th Amendment came from progressive Republican William Howard Taft, in 1909, not long after he was inaugurated President of the United States.

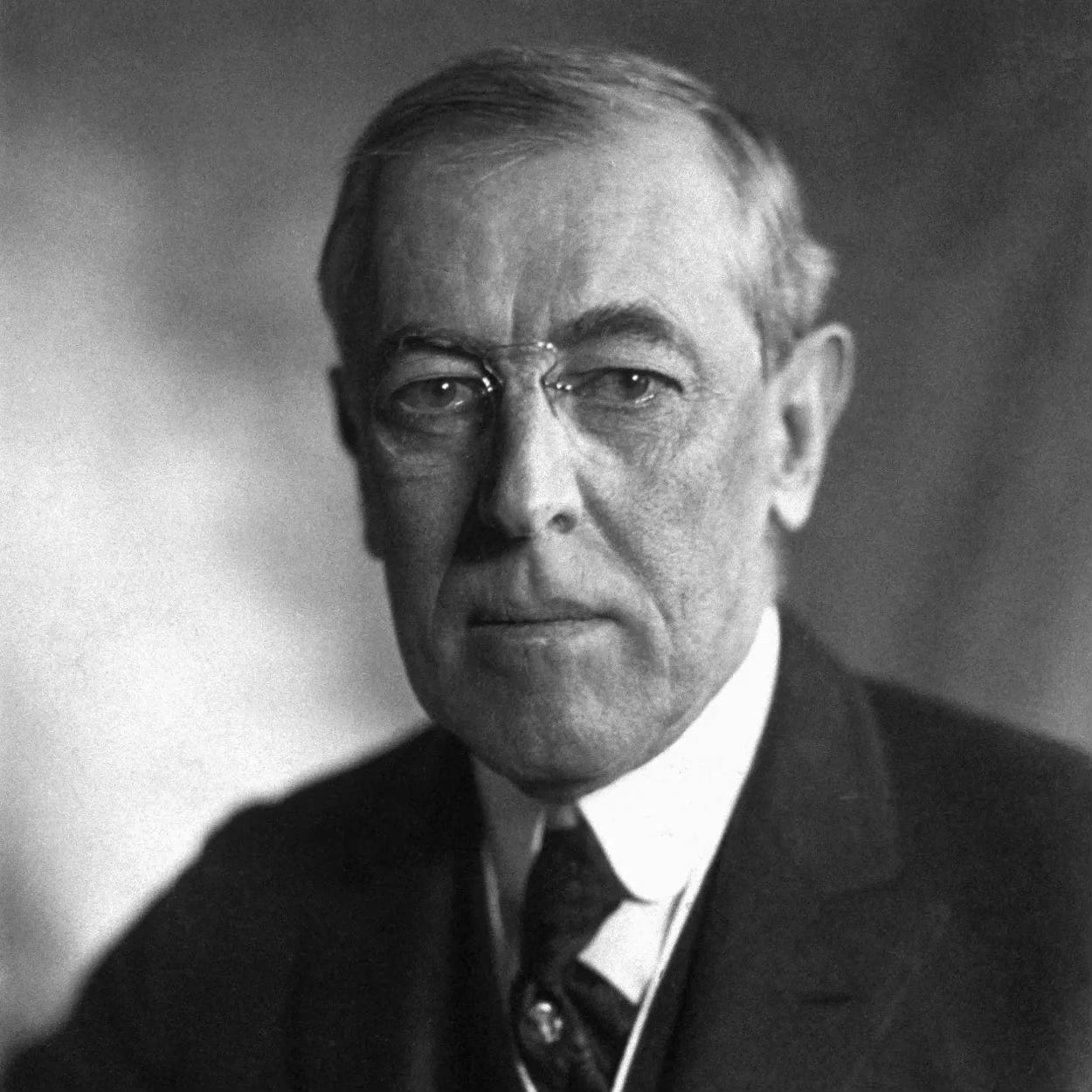

The Income Tax Amendment was ratified by the requite states in February 1913, only a few weeks before progressive Democrat Woodrow Wilson became President, who then lobbied Congress to create a new federal income tax code. (Of course he did.)

Eager to exercise its new power, Congress immediately passed a national income tax law. (Of course they did.) It was a progressive income tax, with higher marginal rates for higher levels of income. There were seven rates total: 1%, 2%, 3%, 4%, 5%, 6%, and 7%.

At the low end, citizens paid 1% in taxes on all income greater than $0 and less than $20,000. At the high end, a few citizens paid 7% on income more than $500,000.

Woodrow Wilson promised income tax rates would remain low. Progressives in Congress promised even more—that the income tax would be temporary.

A mere five years later, in 1918, Congress raised the top marginal income tax rate to 77%. By 1944, Franklin D. Roosevelt’s last full year as President, income taxes reached a soaring 94%, where they stayed at oppressively high rates until the years of Ronald Reagan, who started his Presidency with a 70% income tax rate and concluded with a top marginal income tax rate of 28%.

It is now 2024 and the income tax is still with us. The top marginal rate currently stands at 37%, though progressive Democrats are working feverishly to increase that number and return to the oppressive high taxes of the New Deal era. Further, the power to tax is the collateral the United States government offers to keep borrowing trillions of dollars from foreign (and often hostile) regimes.

Enough!

Government spending is out of control. The national debt is nearly $35 trillion, which is more $10 trillion more than the value of the entire United States economy. Congress has revised or raised the debt ceiling many dozens of times in recent decades—more times under Republican than Democratic Presidents—which is akin to someone with enormous credit card debt raising their own credit card limits.

There is no greed on Planet Earth comparable to the greed of the elite, progressive political class. Those in government don’t even acknowledge any limits when it comes to borrowing and spending other people’s money. More, the progressive political class and their supporters will demonize and denounce in harsh judgmental terms anyone who dares to suggest that maybe those in government should borrow less and spend less of other people’s money.

Want to become an object of scorn and ridicule on Jon Stewart’s and other progressive comedy shows? Want an-depth hit piece against you published in The New York Times? Want to be mocked by Rachel Maddow?

Suggest that those in government spend less of other people’s money, and you’ll get it.

Spending packages are now routinely counted in the trillions of dollars, most of which is spent on blatantly unconstitutional programs that never actually achieve the results promised by chattering progressive politicians.

For any problem that is real—or any problem you or anyone else can imagine—the progressive political class always, always, always offers the same tired solution: Spend more of other people’s money and raise taxes.

Always.

To boot, the uber-greedy political class does not hesitate to tax the same dollars you earn over and over and over. You pay taxes on income, and you think you’ve finished, right? You’ve paid your taxes, right?

Not even close.

The moment you purchase something with your taxed income dollars, you pay more in the form of sales taxes. Buy a home or a car with your taxed income dollars, and you then pay property taxes not once or twice, but over and over and over, every year, according to threats from the government that they will confiscate your property if you don’t pay them annual property taxes.

And there’s more:

Income taxes

Sales taxes

Excise taxes

Payroll taxes

Property taxes

Estate taxes

Gift taxes

Enough!

Here’s an idea: Fund all new government programs through something like GoFundMe campaigns, where individual citizens can voluntarily choose to donate to the programs they value in the amounts they value.

You think a government Green New Deal is a good idea? Great. You pay for it. You want more subsidized health care? You subsidize it. You want more aid to foreign governments that ends up in Hunter Biden’s checking account? You fund it and pay however much you value it!

The 16th Amendment granted power to Congress to “to lay and collect taxes on incomes.” It did not say Congress must lay and collect taxes on incomes.

Perhaps it’s time to replace taxes with voluntary crowdfunding for all government spending programs?

If members of the progressive political class have proposed programs that think are great ideas, they can ask the American people—or, heck, any people, from any part of the world—to fund their boondoggles, voluntarily, where each individual person donates as little or as much as he wants.

Progressives can also explain this new, voluntary system of funding government programs when they go begging to borrow money from foreign governments. How might that go? How many loans will be offered to the United States government? Who will buy U.S. government bonds?

Think of it as: Social justice at last, where individuals pay for the government services they value—in the amounts they value—and no longer have their money taken from them by legal threats of confiscation, prison, and legalized deadly force.